addtime:2023-03-09 author:xinyuren hits:156

in january, china's power battery output totaled 28.2 gwh, down 5% year-on-year and 46.3% month-on-month. the loading volume was 16.1 gwh, down 0.3% year-on-year and 55.4% month-on-month.

this is also the first time in history that a single month fell on a month-on-month basis. from the situation of the same period in previous years, the production and installation of domestic power batteries generally showed a year-on-year increase and a slight year-on-year correction in january. for example, in january 2022, the domestic power battery load was 16.2 gwh, up 86.9% year on year, and the output was 29.7 gwh, up 146.2% year on year; in january 2021, the domestic power battery loading volume increased by 86.9% year-on-year, and the output increased by 146.2% year-on-year; in january 2020, the domestic power battery loading volume increased by 273.9% year-on-year, and the output increased by 317.2% year-on-year.

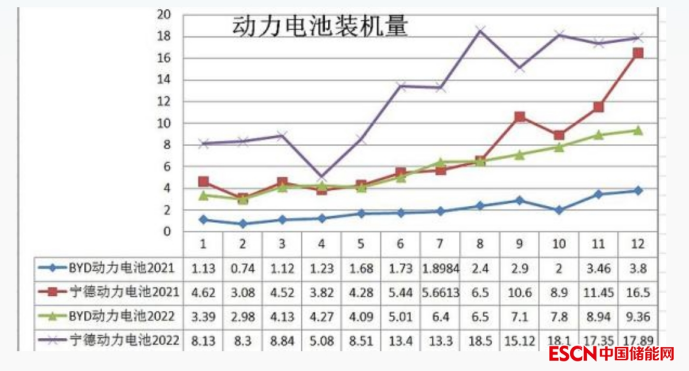

if the spring festival is taken into account, the spring festival in 2022 is in february, but the domestic power battery load in that month is 13.7gwh, also up 145.1% year on year. the output of power battery in that month was 31.8gwh, up 236.2% year on year. from the perspective of manufacturers' performance, in january 2023, the power battery market showed a stable position of the first tier and a steady increase in share, while the second tier was in fierce competition. in the first tier, the gap between byd and ningde era is narrowing in an all-round way.

in january, a total of 35 power battery enterprises in china's new energy vehicle market realized the loading and matching, which was the same as last year. the top 3, top 5 and top 10 power battery enterprises have 13.5 gwh, 14.7 gwh and 15.7 gwh respectively, accounting for 83.5%, 91.2% and 97.6% of the total installed vehicles. it can be seen that the number of power battery manufacturers in china has been reduced from more than 150 in the previous peak to 35 today, leaving few opportunities for new players. the overall market share of the first tier of ningde times and byd is 78.53%, still occupying an absolute share.

however, it is worth noting that since last year, the market share gap between byd and ningde era batteries has been narrowing. in january 2023, the battery load of ningde times was 7.17gwh, accounting for 44.41% of the market, down 5.83 percentage points year on year; byd was 5.51gwh, accounting for 34.12% of the market, with a year-on-year increase of 13.19 percentage points. byd's battery load has soared to 75% of the load of ningde era. in january 2022, the battery load of the former was 41.7% of that of the latter, while in the same period of 2021, the proportion was only 24.5%. by the end of last december, byd's battery had caught up with 52.3% of the ningde era.

according to the data provided by byd, in january 2023, byd sold 151341 new energy vehicles, up 62.4% year on year. in the second tier, compared with the list in january last year, guoxuan hi-tech, honeycomb energy, funeng technology and others fell, while yiwei lithium energy and xinwanda rose. according to the analysis of industry insiders, the supporting hot-selling new energy vehicles are the main driving force for the rapid increase of the load of the second-tier power battery manufacturers. take xinwanda as an example, the company is one of the suppliers of the power battery of the extremely krypton 001. in 2022, the monthly delivery volume of the extremely krypton 001 will be from 1795 to 11337, and the final annual delivery volume will be 71491, which will drive the delivery volume of the power battery of xinwanda.

has the power battery entered the era of overcapacity?

from the perspective of terminal demand, in january 2023, the domestic sales of new energy vehicles also fell for the first time on a month-on-month basis. the production and sales of china's new energy vehicles in the month were 425000 and 408000 respectively, down 46.6% and 49.9% month-on-month respectively, down 6.9% and 6.3% year on year respectively, and the market penetration reached 24.7%. the year-on-year decline was greater than that of the same period in history. the china automobile association said that the change of the data was mainly due to the decline of the subsidy policy for new energy vehicles and the obvious fluctuation of the market price.

according to the analysis of industry insiders, after the market of new energy vehicles has doubled for two consecutive years, it will end its gallop in 2023 and enter a period of slow growth. according to the data of the passenger car federation, in the whole year of 2022, china's new energy vehicles achieved wholesale sales of 6.498 million, retail sales of 5.674 million and export sales of 609000. the penetration rate of new energy vehicles in china's passenger car market reached 27.6%.

the china association of automobile manufacturers predicts that the total sales of new energy vehicles will reach 9 million in 2023, and the passenger transport association predicts that the sales of new energy passenger vehicles will reach 8.5 million in 2023. zhang yongwei, secretary-general of the electric vehicle hundred people's congress, predicted that the growth rate of new energy vehicle sales in 2023 would be 30% - 40%, which would significantly slow down compared with the growth rate of 93.4% in 2022. although terminal demand has stepped on the brake, the frenzied capacity competition among battery giants will continue in 2023.

take byd as an example. recently, zhengzhou fodi battery co., ltd., a wholly-owned subsidiary of byd, plans to invest 8 billion yuan to build a 40gwh/year new power battery production line in zhengzhou airport economic comprehensive experimental zone. at present, the project has passed the environmental impact assessment. at the end of january, byd planned to start construction of a new energy power battery super factory with an annual output of 20gwh in wenzhou, zhejiang. on january 14, the groundbreaking ceremony of byd's new energy power battery xuzhou production base was held. the total investment of the production base was 10 billion yuan, and it is expected to achieve an annual output of 15gwh.

yiwei lithium energy is also expanding its production crazily. from january 18 to february 7, it announced that it would invest in and construct "23gwh/a lithium iron phosphate cylindrical energy storage battery project", "60gwh power storage battery production line and auxiliary facilities project" and "20gwh/a power storage battery production base" in qujing, yunnan, jingmen, hubei and jianyang, sichuan respectively. if the projects currently planned by the two companies are all completed and put into production, byd's battery capacity will exceed 600gwh, and yiwei lithium's battery capacity will exceed 320gwh, which is close to 1000 gwh.

in addition, throughout january, the dazzling investment announcement in the industry also included that funeng technology planned to invest in the construction of a 30gwh power battery production base in guangzhou economic and technological development zone. bike battery large cylinder production base is located in changzhou, planning to build 30gwh large cylinder battery production line and international research and development center. ganfeng lithium plans to invest 10 billion yuan in the fuling high-tech zone of chongqing to build a power battery project with an annual output of 24 gwh and a pack assembly line with an annual output of 10 gwh batteries and related supporting facilities; it is planned to invest and construct a new lithium battery and energy storage headquarters project with an annual output of 10gwh in dongguan, with a total investment of 5 billion yuan.

according to the calculation, in 2022, china's power battery output will be 545.9gwh, while the cumulative load of domestic power battery in 2022 will be only 294.6gwh. after deducting the export volume of 68gwh, the difference between the annual battery output and the loading volume in 2022 reached 183.3gwh, with the loading volume accounting for only 61.6%. in fact, there has been overcapacity. however, in 2022, china's export of power batteries accounted for 12.47% of the total output. in january 2023, the battery exports of china's power battery enterprises totaled 7.9gwh, accounting for 28% of the total output, and continued to show a growth trend. it is expected that the overseas market will continue to expand, which will undoubtedly provide a good export for the release of domestic battery capacity.

in the view of some insiders, for the current power battery manufacturers, the expansion of production seems to be an inevitable choice under the "prisoner's dilemma" in economics - the total market value is fixed, and each enterprise can only determine its own optimal solution. the leading enterprises hold a large number of long-term orders and must increase production in order to stabilize market share; second-tier and third-tier enterprises also have to continue to move up. the new energy industry investment promotion policies of local governments undoubtedly promote the process of the game.

regardless of whether the capacity of power battery will be surplus or not, the capacity growth of power battery will not stop for a period of time. the production capacity problem that the industry is experiencing and worrying about is the "pain" that the industry must experience. next, the market will inevitably enter the stage of merger and reorganization, survival of the fittest.

the popularity of the new energy vehicle industry has continued, driving a significant increase in the number of power batteries installed. the popularity of the lithium battery sector remains high, and the industrial chain has set off a boom in investment and production expansion.

the popularity of the new energy vehicle industry has continued, driving the substantial growth of power battery loading, and the popularity of the lithium battery sector remains high. the industrial chain has set off an upsurge of investment and production expansion.

in the construction of new power systems, new energy, coal power, gas power and other forms of power supply need to be repositioned.

> company:0755-84611586

> fax:0755-84611589

> special line:4008855199

> email:xyr@xinyuren.com

> add.:shenzhen longgang district liuzhou street back to hon long bu community peak (longgang) industrial plant no. 2 workshop